In this new study, we assess the macroeconomic implications of a Category 5 hurricane hitting Miami, using a novel combination of natural catastrophe models and economic forecasting. Given the mounting challenges in the property insurance market, particularly in high-risk areas like Florida, we analyze how these factors could impact the housing market and the broader economy.

By examining two scenarios—one with generous state and federal aid and another with minimal intervention—we reveal the potential economic fallout, including significant insured and uninsured losses, GDP impacts, and shifts in population and property values.

What if a once-in-a-generation hurricane were to hit South Florida this year?

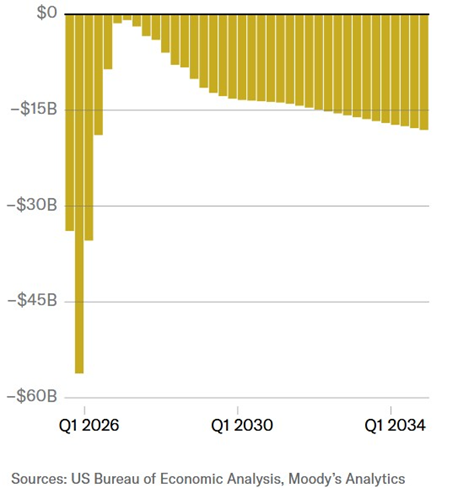

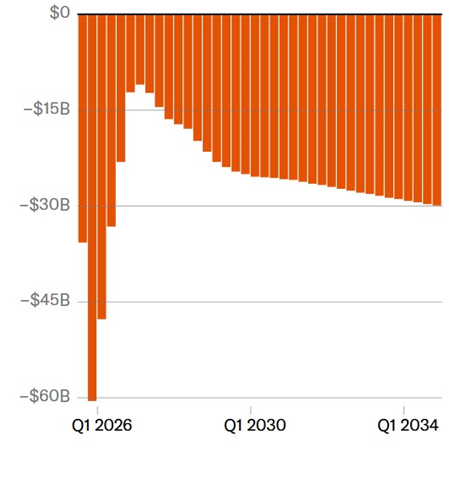

The hurricane would cause a gross metro product (GMP) decline of 30% in Miami-Dade County in Q4 2025, far worse than a typical recession. Recovery is faster in the moderate scenario but leaves a 5% gap below baseline forecasts in the severe scenario.

A Tale of Two Scenarios: Gross metro product of Miami-Dade County

Net GMP loss from baseline estimate, in billions of dollars.

Moderate Scenario

Severe Scenario

Explore the full interactive data story, including loss estimates by ZIP code.

|

On-Demand Webinar - Now Available The Rising Cost of Disasters—Implications for Insurance and the Economy Since 1980, the U.S. has faced 403 meteorological disasters, costing $2.9 trillion—with 18 of the top 20 occurring in just the last 20 years. As the national stock of homes and buildings grows, more assets are exposed to catastrophic storms, fires, and floods, while rising losses have driven insurers out of high-risk markets like California and Florida. Join us to examine the macroeconomic consequences of a Category 5 hurricane striking Miami-Dade and what’s at stake for insurance markets, economic recovery, and disaster response. |

|

Coming Soon: Podcast - Inside Economics A deep dive into the macroeconomic fallout of a Category 5 hurricane—from insurance market shocks to broader economic disruptions.

|

Moody's Analytics also offers macroeconomic climate risk scenarios enabling organizations to assess the impacts of physical and transition climate risks for their business. View our climate risk scenarios brochure, or contact us for more information.